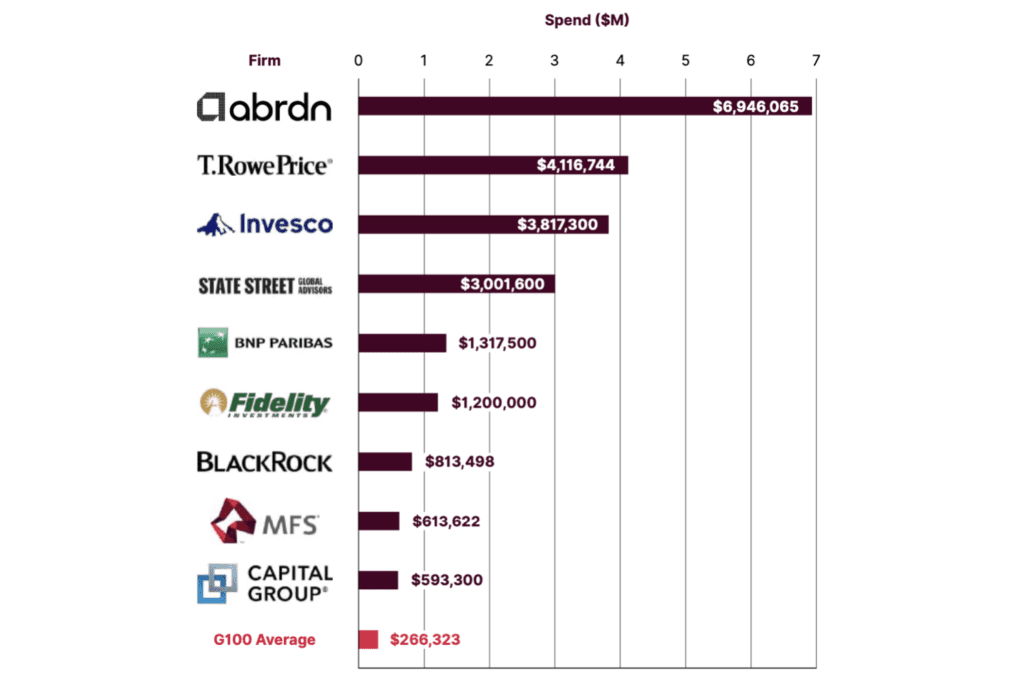

Total spend of the ten leading asset managers in the Paid Media category. Data is collected from four key locations globally, The US, UK, Germany, and Singapore.

Image source: Peregrine – The Global 100 Report 2022

But why the sudden enthusiasm for distribution technology? It is not just that asset managers are focusing more on a) cutting costs in their sales teams and b) improving distribution efficiency, but also c) reflects an unblocking of digital transformation resistance that existed before Covid-19. This year, distribution technology will be shaking things up. We have already seen asset managers from across the global investment industry reducing their distribution teams and adopting new technological tools, such as data platforms (think, eVestment), virtual due diligence (think, Zoom), client analytics to uncover client needs and preferences (think, Pardot), and client experience applications to improve client acquisition and retention (think, video).

The asset management industry is getting more concentrated. What I have experienced first-hand are three trends:

1) Investors have (nearly) infinite choice in investment solutions and products;

2) Small- and medium-sized sales team have increasingly had to fight uphill battles with their larger and more resourceful competitors to get noticed and grow assets under management; and

3) The investor engagement journey (sales and retention) with clients and new potential clients is more dynamic than before.

What remains a constant is that investors need thoughtful insights and useful advice. Communication is a vital tactic and tool during the client acquisition and retention journey. A recent Peregrine report [reference above] opines that “the next decade will see growing emphasis put on resilience, reputation and business sustainability itself.” Yet, it will come as no surprise that those asset managers with middling value propositions and ineffective communication will continue to face challenges in competing and surviving. Delivering to the evolving needs and expectations of investors will require even the best asset manager to acquire greater tech-savvy distribution capabilities.

Distribution technology will alter not just how asset managers do things but also what they do – and, critically, what they don’t do. Some things are done most efficiently in-house, the rest can be outsourced. Pinning down just to what degree technology will displace human-based advice and engagement is challenging, but to earn trust and serve clients well for the long-term is an art. As I’ve learnt, those all-important feelings of human connection and trust are even more vital when investors are seeking insights on how to adapt to changing realities and embrace new opportunities arising.

Human values and relationships are the foundation of meaningful investor dialogue and successful business dealings. Still, the potential of technology to support distribution in our industry has never been more important.