23 February 2022

Active investors and traders have always used a variety of sources to inform their trading decisions. But those channels are changing — especially for the younger, newer entrants to the market, who value conversations on social media and often skip traditional market research altogether.

Among these new investors, 27% reported turning to Reddit as a news source, with others mentioned YouTube (37%), Facebook (25%), and TikTok (12%), while 33% reported reading annual reports from companies they’re interested in.

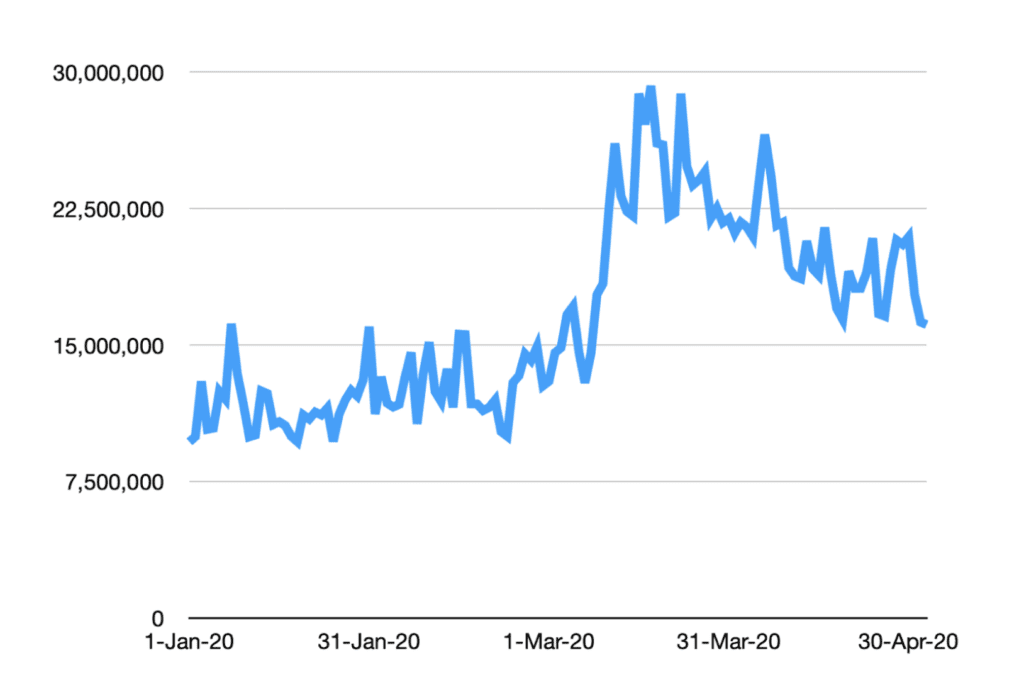

But in times of crisis — for example a global pandemic — consumption of mainstream media rises significantly. Uncertainty makes people crave understanding, and that means turning to the experts.

Still, investors at any level can only invest in what they know — or what they’re able to discover. It’s a crowded market with more financial products, opportunities, networks, funds, and distribution models than ever.

So it’s up to investment advisors to speak up and stand out, especially when times are tough. Communication is a critical responsibility of any asset manager towards their clients, and if you stay silent too long, you may no longer have any assets to manage at all.

Number of unique visits to BBC News from January to April 2020.

Source: BBC.

Why silence is the worst response to a crisis

As an asset manager, it’s understandably frustrating when things aren’t going well. Client expectations — not to mention those we place on ourselves — are sky high. We are constantly in a game of mental chess with ourselves, trying to gain clarity on complex circumstances that are often out of our control.

When advising or presenting to our clients, we want to remain a figure of authority — but that doesn’t always mean having all the answers. There is a tendency in our industry to over-share when things are going well, and downplay any sub-optimal performance.

But the reality is that in times of struggle, sharing updates, insights, perspective, and outlook are more important than ever. We all know volatility is a part of our work, and it’s our job to make that palatable to our clients through a compelling story.

In short: we have to remind our clients why they invested with us in the first place.

If you stop communicating with your clients in a down period, you’ll not only lose investors, you’ll stop attracting new ones, which is a very tough hole to dig yourself out of. And if you stay silent too long, you can be sure someone else will take your place

Prioritizing communication in downswings

When things are going well, marketing is easy. Success speaks for itself, and you can reliably depend on positive word of mouth references to find new clients.

But when times get tough, strategic and authentic communication is what distinguishes the real professionals. You can bet that when the market takes a dip or one of your funds is struggling, your clients have already noticed. Staying silent will immediately make clients question not only your capability but also your integrity.

In April 2020, shortly after the first wave of Covid-19 shutdowns in the US, Fidelity Investments announced that they were hiring 2,000 new employees to help with customer service.

“As the last few months have reinforced, most people still want to talk with other people in times of economic uncertainty, particularly when it comes to concerns with personal finances, retirement, and investments,” wrote Abby Johnson, Chairman and CEO of Fidelity Investments, in her LinkedIn post explaining the surge in hiring.

The effort seems to have borne out, as later that year Fidelity moved into the number one spot on the Global 100, an annual ranking of the integrated marketing and communications of asset managers.

The special obligation of financial advisors

It is tempting, during periods of uncertainty or disappointment, to sit and wait — to want to find an explanation or a solution before sharing any information. But silence is anathema to authenticity, and someone else will always be there to fill the void.

From: When people are ready to invest, digital is their first stop.

Source: Google Data, U.S., July-Dec. 2015 vs. July-Dec. 2017

In the end, people invest in people, and there will always be someone else who claims to have a safer, better, more future-proof investment strategy. With a continued authentic presence, you can convince clients to stay and new clients to join; without that presence, you’ll lose every time.

As an advisor you owe it to your clients to share your expertise and perspective, and — when appropriate — give reassurances. This is an obligation at the heart of the role. But beyond that, it is also an opportunity to build relationships, position yourself as a leader, and emerge even stronger.

According to Google, searches for investment advice have risen significantly year-over-year, with a 75% jump in searches for “financial advisor” and 86% of potential investors spending more than an hour doing online research.

By communicating consistently, you’re ensuring that those early-stage investors find you and keep coming back for more. Because if you’re not showing up where and when investors are looking, you can bet someone else is.